I’ve lost count of the number of times we’ve turned around in 2024 – but last night’s is clearly the one that offers the most certainty of being right. In January we were already close to the certainty of seeing rates fall 6 to 8 times – there was no doubt about it – but last night, this time it is more than certain; the FED will cut rates by 25 basis points in September and repeat the same just before Christmas. It’s practically set in stone and to celebrate all the indexes are hitting their all-time highs. Well, except Switzerland, but that’s because they don’t have any like us.

The Audio of May 16, 2024

Download the podcast

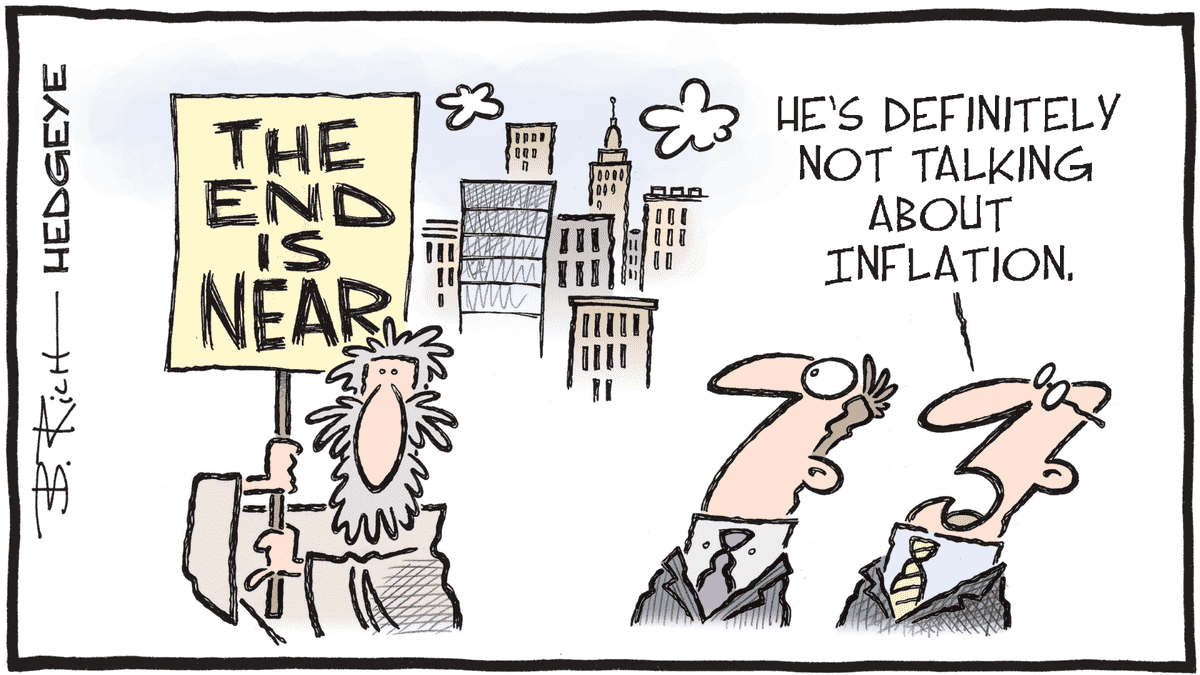

WE OVERCOMED INFLATION (well, almost)

There it’s done. Inflation is finally under control and Powell is once again the KING of Washington. Nothing will ever be able to slow down his rise and he will remain the man who defeated inflation through rate hikes and who was able to bring the economy back exactly where it needed to be to ensure the sustainability of the American Empire. Amen. So yes, I may be getting to work A LITTLE quickly, but that’s not me, that’s just what we can read in the American media which are all celebrating the fact that the three indices of the new continent have finished at its all-time high. Small disappointment; The Dow Jones did not cross the 40,000 mark immediately, but it is to benefit better this evening, without a doubt.

You will have understood, the inflation figures came out exactly as expected and for the first time since the start of the year, the data is weaker than the previous month. Publication which therefore deserved that we douse ourselves abundantly with overpriced champagne, not without having slathered ourselves with caviar beforehand. If we have to talk numbers, we will therefore remember that the CPI came out at 3.4% compared to 3.5% the previous month. The monthly measure was 0.3% compared to 0.4%. And on the CORE CPI side, it is even better with 3.6% against 3.8% and also 0.3% over the month once we get rid of the “volatile components” – in other words: “things that are useless like energy, rent or even food”.

A huge WOW of relief

This new volley of figures therefore allowed stakeholders to breathe a huge sigh of relief and the markets peacefully soared to their all-time highs. And then, as happiness never comes alone, we were also able to appreciate the publication of retail sales figures which were also down compared to the previous month. Data which, again, allowed traders to shout their joy and their appreciation to see that the economy is slowly slowing down and will therefore logically allow the FED to lower rates – as planned for months. Weak retail sales mean the consumer is squeezing their butt and “spending less”, which also means they are also “less fit” or “a little more screwed”. In a normal economy, this would not have been considered a positive signal, but since right now, we ESPECIALLY want inflation to calm down, we were on the verge of a stock market orgasm. Not to say: “right in it”.

The markets therefore immediately realigned their expectations. From now on we expect our two rate cuts by the end of the year – the most optimistic are even talking about three cuts by the end of the year. In short, euphoria was among us and doubt was no longer allowed. The FED has won the fight, inflation is down, on the champions. The stock market is still easy when you’re always right. So, I don’t want to spoil the party, but when you see the list of individual prizes, you have the right to wonder if you really need to celebrate or if you’re not getting a little carried away. One thing is certain, on Wall Street, we are friends of raw figures, capable of finding the best in a rotten figure and sometimes, we have a tendency to skim over the figures without seeing where the rotten things are hidden.

Individually

While the CPI is 3.4%, inflation is much higher for many basic necessities:

Auto insurance up 22.6%

Transportation is up 11.2%

Hospital services increase by 7.7%

Vehicle maintenance increases by 7.6%

Maintenance cost inflation for property owners is 5.8%

Rents jump 5.4%

Electricity advanced by 5.1%

And then we must also remember that inflation has been above 3% for more than THREE years. Which means these inflation figures come on top of several years of already inflated prices. So yes, ham is down 3.4% and cheese is down 3.3%, just like coffee which is down 2% – which will surely improve Starbucks’ margins – but these microdrops don’t solve the problem. the fact that financial accessibility continues to deteriorate and that the consumer is under more and more pressure. But when it comes to yesterday’s figures, we’re not going to lie to each other: as much as we are hyper-neutral at finding the positive in a really rotten figure, we are even stronger at refusing to see what’s wrong when a figure we arrange. Which was the case yesterday. So we’re not going to spoil the party: everything is fine, the stock market is doing well, Wall Street is on top of its game and we’re going to go for 40,000 on the Dow Jones. As for the reality of the facts, for the rest of the problems that could possibly fall upon us, we will see later. Yesterday it was “LET’S PARTY” and that’s it!

Inflation but not only

Once we acted on the fact that inflation was DEFEATED, the markets rushed to the old books to celebrate. We immediately bought classic stocks like Apple, Microsoft and Nvidia, because technology is good but artificial intelligence is even better. Nvidia gained 3.6% and its sidekick, SuperMicro, exploded by 15%. Where there is embarrassment, there is no pleasure. Cisco published figures below expectations after closing, but the guidance was positive, the former technology star still jumped 5% late at night and when you look a little; yesterday there WAS NO BAD news. Or maybe we preferred not to bother the Bull Market with that. We even had Joe Biden rushing to give a speech RIGHT after the CPI was released to take his victory lap and say how happy he was that inflation was at a three-year low. Without specifying that it has been 38 months since it fell below 3%. And the yield on the American 10-year bond is at 4.31% – the lowest since April 3.

The magical effect of American inflation continues to have its effect on the other side of the planet, since this morning the Asian markets are all in the green. The Nikkei is up 0.78%, the Hang Seng advances 1.6% and China scrapes 0.5% as the “should I buy China before it’s too late” issue resurfaces . Still, tariffs are still a problem for China and in Japan the GDP numbers weren’t very explosive either. The latest figures published overnight show that the Japanese economy contracted much more than expected during the first quarter of 2024, with private consumption falling sharply due to inflation that was too high and wages too low. But honestly, we don’t care, first of all Japan is far away and then the ICC yesterday was still so great!!!

For the rest

Otherwise, we note that oil doesn’t really care about what’s happening and seems to want to consolidate at $79. Gold should fall because inflation is “almost defeated”, but it is not falling, because it is still a bit “the trade of the moment” and the yellow metal is at $2,393. Bitcoin, for its part, gave us one of the best days in a long time. The crypto gained almost 10% and stood at $66,000. In today’s news, we note that it is the season when large investment funds announce some of their positions and it should be remembered that Berkshire Hathaway announced the name of their “mystery position” – Warren Buffet has therefore took a 6% stake in Chubb. And then Michael Burry sold his Alphabet shares to buy gold.

On another note, it should be remembered that Memes Stocks have deflated (for the moment). GameStop lost 20% during the session and 10 after the close. AMC plunged 10% plus 6 after close. It should also be remembered that Dell is diving ever deeper into the theme of Artificial Intelligence – Dell took 11% here and clearly crossed the 100 billion market capitalization mark. There is also IBM and Palo Alto Networks which announced that they would work together to be more effective in facing the challenges posed by Cybersecurity.

Side figures of the day

Today we will have the publication of building permits, new construction starts, the Philly FED and industrial production in the USA. But the thing that we are really going to look at is Jobless Claims, just to see if they continue to show signs of weakness on the job market – which would corroborate our certainties about the forecasts of declines in rate rate. There will also be figures from Walmart, Baidu and Applied Materials that will need to be observed along the way. Just to see how the consumer is doing. And this, even if everyone would prefer that it not go well, just to calm inflation a little more.

For the moment, futures are up 0.18% and we are swimming in happiness while waiting for the SMI to climb 10% to reach 13,000 and the highest of all time. For my part, I wish you a very nice day and we will see you again tomorrow to finish the week!

See you tomorrow !!!

Thomas Veillet

Investir.ch

“Compound interest is the eighth wonder of the world. He who understands it deserves it. Anyone who doesn’t pays for it. Albert Einstein